Investing in Silver

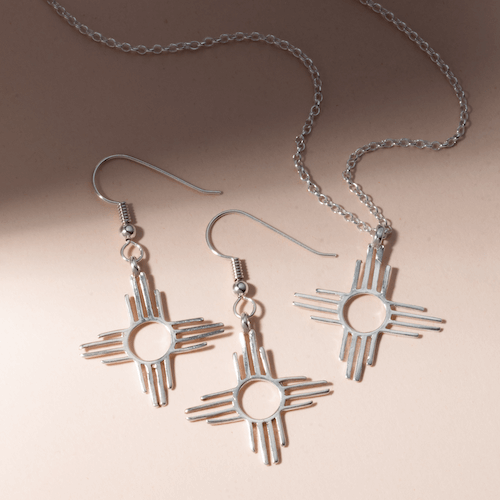

Over the years, Native American jewelry has retained its popularity for a variety of reasons, one of which is its value as an investment. Authentic Native American jewelry made of sterling silver becomes a family heirloom and a valuable asset for the buyer. Precious metals such as silver and gold have been traded as currency for thousands of years. In today’s commodities market, the value of such metals may fluctuate according to supply and demand, but their worth as an investment remains strong.

If one is looking to purchase silver strictly as an investment, however, there are other ways to do so. A buyer who desires a tangible asset they can keep may purchase the actual silver in physical forms such as bars, rounds or coins. If the investment is more the goal, buyers may prefer to purchase what are known as ETFs, or exchange-traded funds, where the silver is held in a secure location for them.

Silver bars are almost pure silver and come in a variety of weights. Standard weights for these bars are: 1 oz; 5 oz; 10 oz; 100 oz and 1000 oz. They may be purchased from major banks and bullion dealers. Silver bars are traded at current market value and sellers often charge “premium fees” for the sale. It is more cost efficient to purchase bars in bulk, as the smaller the bar, the higher the premium fee the buyer pays.

Silver rounds are one ounce of 99.9% pure silver. Private companies mint them here in the US. Each company places designs on them. Designs vary according to the production run the rounds are minted during.

Collectible coins are another way to purchase silver, but there are some important considerations if you are looking to them for an investment. The value of the coins more often relates to their collectability than the amount of silver in them. Half-dollars, quarters, and dimes minted before 1965 contain ninety percent silver and are the more valuable.

Silver investors might also look at purchasing stock in a silver mine. This may be a profitable way to add to your portfolio, but it also comes with a risk that bars, rounds or coins do not. Purchasing stock means you are assuming not only the risk of fluctuations in the market value of silver, but also the ups and downs of the mining company. Should you decide to take this option, you should do a careful assessment of the company that runs the mine.

Caution should be an important tool in choosing any of these methods for purchasing silver. Buyers should look for a reputable dealer to purchase from. Advice on dealers can be found on the website for the US Mint. There are other things a buyer can do to prevent being taken advantage of in a sale. A “troy ounce” of silver is the price per raw ounce. Buyers should look up that price so they know that what the seller is charging is in line with that amount. Premium fees should be clear up front and buyers should ask about the seller’s buyback policy. Some sellers will buy the silver back, some will not. A buyback policy offers the insurance of having at least one option when you’re ready to sell your silver.

Reputable dealers will also give documentation of the sale and the cost of the silver you’ve purchased. This is important tax information you’ll need when your silver gains in value and you sell it. Buyers opting for an ETF rather than the physical silver need to know how the seller holds the actual silver. This can prevent delays and obstacles should you decide to request the physical silver in place of the ETF.

No matter how you choose to invest in silver, the most important detail is to choose a reputable seller to deal with. Should you decide to invest in silver through Native American jewelry, a reputable dealer is also extremely important. Your assets and your peace of mind will thank you for making that step.

Resources:

http://www.bankrate.com/finance/investing/buying-and-selling-silver-1.aspx

http://the-moneychanger.com/answers/ten_commandments_for_buying_gold_and_silver

http://www.wikihow.com/Buy-Silver